Vodafone Foundation donates €30,000 to support Mozambique over Cyclone Chido

Vodafone Foundation has pledged €30,000 to Save the Children in response to the devastation caused ...

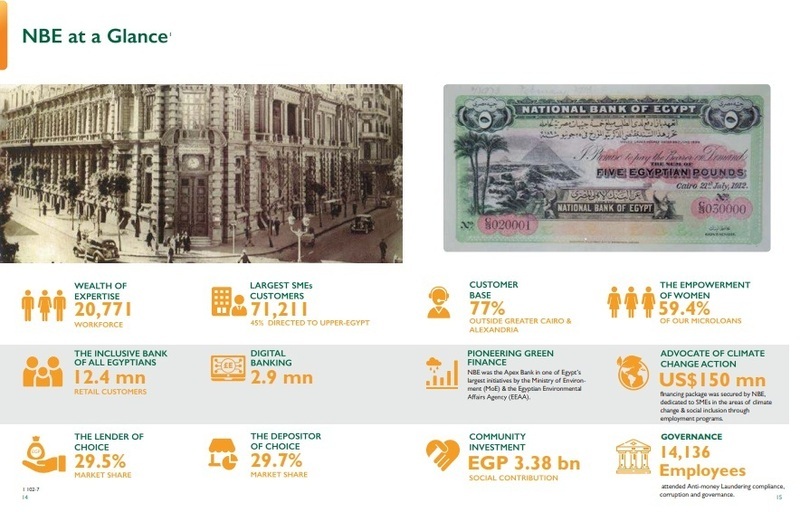

The National Bank of Egypt (NBE) has issued its first sustainability report in line with the Global Reporting Initiative (GRI) Standards. The report highlighted that the bank channeled $ 150 million into climate action projects in addition to EGP 3.38 billion into social activities.

The report was entitled “120 Years of Banking and Beyond” as the bank have served the Egyptian society and economy for more than 122 years.

The bank’s first sustainability report profiles the NBE’s performance beyond profit and in alignment with Economic, Environmental, Social and Governance (EEGS) indicators.

This report is coming out during a disruptive time for all humankind with the outbreak of the COVID-19 pandemic. It is a time for individual, social and environmental solidarity, where everyone plays a role in how to get through this together.

NBE Chairman Hisham Okasha said “Our first Sustainability Report redefines our banking purpose & performance from financial to EESG, marking our baseline year & drawing our vision for purpose-driven banking towards Economic Prosperity, Planet Conservation, & People’s Well-being.”

“2020 celebrates a long and dedicated history of NBE’s 122 years of sustainable banking for the prosperity of the Egyptian people. Our first sustainability report profiles NBE’s performance beyond profit and in alignment with Economic, Environmental, Social and Governance (EEGS) indicators. Sustainability as a global direction for the banking industry is not a new concept for us,” he added.

“We stood side-by-side with the Egyptian people to meet their financial needs. After the flotation of interest rate investment certificates with a total of EGP 545 bn. We contribute to national megaprojects by investing in large corporates in pivotal sectors of the economy, such as tourism, infrastructure, industrial and agricultural. In accordance with our endeavors for stimulating small businesses growth, we have strategically focused our enterprise banking on remote and underserved regions with 45% of our current SMEs lending portfolio directed to the Upper-Egypt region to raise its competitiveness. Our work directly contributes to employability promotion and job creation for young Egyptian men and women,” he said.

NBE is key driver to Egypt’s transition to green economy:

Okasha said “we consider ourselves the drivers of Egypt’s transition into a green economy. Over the last twenty years, we aligned our business with the country’s climate change outlook and we voluntarily funded green initiatives for energy efficiency and renewable energy. Since 1998, NBE as the Apex Bank, has cooperated with the Egyptian Environmental Affairs Agency (EEAA) and managed the finance of the Egyptian Pollution Abatement Program (EPAP). The program focuses on combating industrial pollution and promoting the concept of cleaner technology in order to mitigate GHG emissions (reducing 670,000 tons of CO2 in 18,000 industrial facilities) in cement, iron and chemical industries.”

NBE was the Apex Bank in one of Egypt’s largest initiatives by the Ministry of Environment and the EEAA. Grant funds reached 7.17 million euors.

EU funded the industrial sector with more than EGP 1 billion through the EPAP2 project, resulting into carbon emission reduction of 650,000 tons CO2 annually. The program was funded by the Aid Danish (DANIDA) and under the umbrella of the Federation of Egyptian Industries.

“During the program’s three phases we cooperated with multiple development partners; the World Bank, the European Bank for Reconstruction and Development, the Japanese Development Bank and the German Development bank with over EUR 330 million. NBE’s carbon footprint has been improving over the years as we took tremendous steps internally towards reducing GHG emissions by building solar systems for branches with total number of 28 stations. We thrive to continue directing the market’s attention towards green finance and the future of our natural resources,” he said.

The report said the NBE took robust measures to enhance efficiency rationalization. Through its increased dependence on renewable energy, NBE has managed to reduce its carbon emissions by 206,000 tons annually.

Moreover, the NBE is the first partner of the European Bank for Reconstruction & Development (EBRD) to finance climate-related projects.

The NBE secured a $ 150 million financing package dedicated to SMEs in the areas of climate change & social inclusion through employment programs.

The banks has allocated a total funding amounted to EGP 28 million to energy preservation initiatives with extending finance for innovative solutions through recycling of sewage waste water and agro wastes aimed to generate electric power with an hourly capacity reaching KW499 / hr for residential areas. This is in addition to replacement and transformation of industrial furnaces to bio-energy or renewable energy driven alongside organic fertilizers production with total financing standing at EGP 40 million.

NBE launched 1st-ever CSR unit in banking sector:

The NBE was the first to launch a “corporate social responsibility (CSR) Unit” in the Banking Sector in Egypt over 50 years ago.

“We invest in the communities in which we operate through strategic philanthropy that goes beyond corporate donations. Social protection, care and development are NBE’s mantras and correspond with social development national goals,” NBE Chairman Hisham Okasha said.

“We have been the most impactful companion to the Egyptian community through our two arms; CSR Department and NBE Foundation. Our contribution mounting to an average of 9% of NBE’s Net profit, stands at EGP 6 billion in net funding since 2014,” he said.

“We work with our strategic partners to ensure Quality of Life for Egyptian citizens and address the most critical issues of community needs: Education, Health, Housing, Debt Relief, Women Empowerment and Disability Integration. NBE Foundation’s relief fund supported families suffering from personal debt burden (Al Gharmeen) with EGP 75 million in tandem with Misr El Kheir – a non-governmental organization (NGO). Our funding is paired with an income generation program to support their life-long financial goals and to start small businesses in handicrafts.”

“We received regional recognition for the past two years from the Arab Organization for Social Responsibility, being the only Egyptian bank with a golden excellence award in CSR.”

The bank is the largest social funder and contributor to social national development goals. The NBE leaves No-One behind. In 2019, the bank secured jobs for 177 employees with special needs.

According to figures released by the report, the bank earmarked 59.4 percent of its microloans to women empowerment.

The NBE march of sustainability:

Sustainability will no longer be a luxury. The NBE established its New Strategic Sustainability Agenda, as a comprehensive 5-year plan. The NBE Board announced and mandated the first step for the preparation of this report, marking a new era of monitoring, discussing, and reporting on NBE’s Sustainability efforts.

The NBE is looking forward that this report will be leading the way towards a new benchmark in the Egyptian banking sector.

The NBE particularly focuses on the most vulnerable communities, women, youth, low-income households and people with special needs. The bank’s strategic sustainability framework is in alignment with local, regional and international development agendas. The United Nations Sustainable Development Goals (SDGs) and Egypt Vision 2030 are the main pillars that guide the bank’s business lines.

The NBE embodies the UN Sustainable Development Goals (SDGs) across its entire spectrum of functions, while the three sustainability pillars – economic, social, and environmental – have guided NBE’s operations early on since inception.

In July 2018, NBE’s Sustainability Framework started to take shape in synchronization with the NBE’s updates of its Strategy Pillars to align with the new CBE guidelines. Aligned with National Priorities and CBE’s continuously evolving plans for financial inclusion, cashless society, and green financing, sustainability in NBE started its transition from a “CSR Activity” model, to a full-fledged framework late 2018, mandated by the Chairman, as the delegated authority to oversee the development of Sustainability Practices in the bank.

Currently operating and monitored through a dedicated unit under the NBE’s Strategy, the bank’s Sustainability Framework has a direct reporting line to NBE’s Chairman to ensure alignment with emerging risks, regulatory guidelines, national needs, and business priorities.

The Chairman and Board discussions on economic, social, and environmental topics are part of NBE’s identification process for critical topics and their impacts, risks, and opportunities. Implementation of the Board’s decisions and due diligence process is then conducted under the Supervision of the Strategy Department and its affiliated Sustainability Unit.

Micro financing remains the main enabler to social well-being through economic prosperity. The alleviation of exclusion barriers has been front and center in its Risk Management approach to achieve NBE’s strategic goal for financial inclusion.

NBE was able to increase its micro lending by 50% and it has successfully and actively assisted include 6000 new clients to become bankable and migrate to the formal economy NBE has helped 9,500 individuals to become recognized legal entities and actively contribute to the economy, which has made them eligible for their first micro financing through NBE.

NBE equally played an active role with new client registrations for the Central Bank Micro Initiative (Your Project). As a result, 200 clients have received their first micro financing through NBE in 2019. Financing new establishments represents 13% of the total client base and 25 percent of the affordable limits under the CBE small financing initiative amounting to EGP 11 billion.

As the world moves to digitization, the NBE has proudly launched its Flagship Digital Branch in 2018, as the first Digital Branch in Egypt. By mid 2019, the bank has reached a total of 4 branches in Cairo and Alexandria. The NBE is targeting 25 branches by the end of 2020.

The NBE is an icon in the banking sector in its efforts to serve CSR and achieve the UN Sustainable Development Goals and Egypt Vision 2030.

Vodafone Foundation has pledged €30,000 to Save the Children in response to the devastation caused ...

The European Commission has adopted a decision to disburse €1 billion in loans to Egypt following ...

Opening the Helwan University clinic brings the total number of Safe Women Clinics to 48 ...

اترك تعليقا